The S&P finished last week at yet another all time high, and the FTSE saw its 5th consecutive week of gains for the first time since the pandemic began. With the vaccine rollout beginning as early as next week in the UK, and with oil climbing towards $46 after OPEC agreed to curb increases in production increases, the markets see plenty reason for optimism.

Gold rose nearly 4% making up some of the ground it lost a few weeks ago. Whether it falters from here or keeps marching higher, time will tell, but from a macro perspective it looks strong.

High debt + high liquidity = perfect conditions for gold

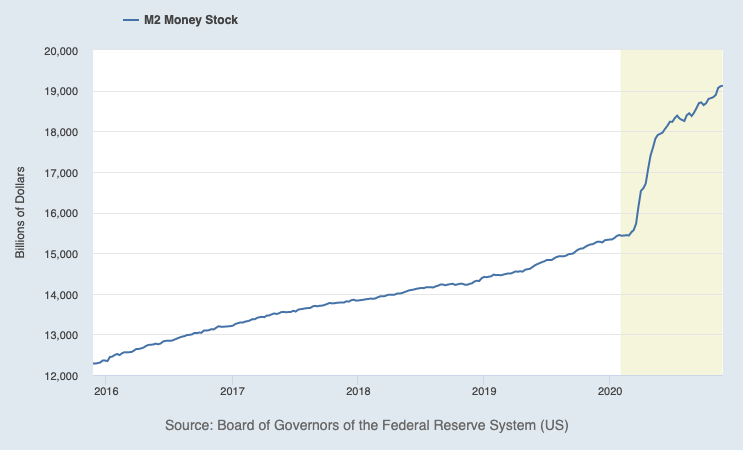

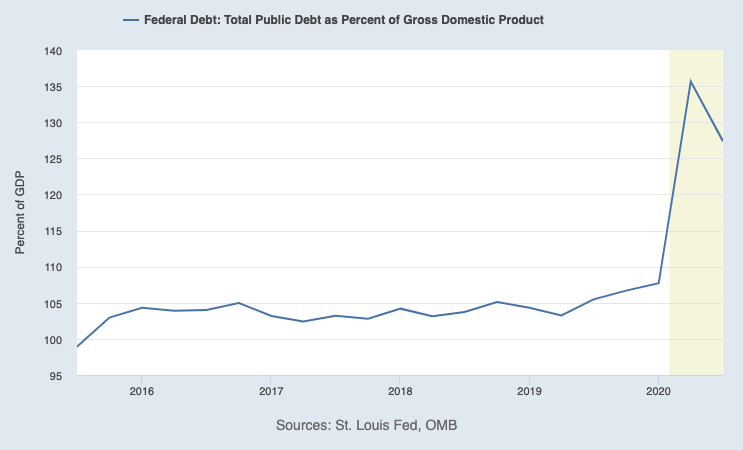

Gold thrives in high debt and liquidity environments – two things which have accelerated sharply since the pandemic, seen clearly in the data below.

U.S debt now stands at 127% of GDP, and the M2 Money Supply (aka the number of dollars in circulation) has seen an increase of 23% in only the last 9 months alone.

The case for gold was already strong, but policies and actions taken in response to the pandemic have only strengthened it further.

Because gold doesn’t yield anything, holding it usually carries an opportunity cost relative to other assets. But with interest rates and bond yields near all time lows, the cost of holding gold looks set to stay low for the foreseeable – especially given the lack of inflation.

Even if inflation were to appear and put pressure on interest rates to rise in the future, with such record levels of debt, any increases will be hard for the economy to swallow, especially if it wasn’t seeing the necessary growth.

From every angle gold looks the obvious trade.

The dollar falling below 91 last week only served as further confirmation given the two are (traditionally at least) inversely correlated.