The macro story continues to be driven by treasury yields which have risen notably in recent weeks in anticipation of the stimulus announcement by the incoming Biden administration – partly because it increases the risk of inflation, but also the supply surge of newly-minted Treasury bonds necessary to finance it would be expected to push prices down and yields up.

Were yields to keep rising, the Fed would almost certainly intervene and buy in order to contain them, so you’d expect them to keep trending lower beyond the short-term.

Consequently the S&P saw something of a pause (as low bond yields are one justification for higher stock prices) and gold continued to fall given its inverse correlation to bond yields.

In the UK, the FTSE made a strong start last week before ending down 2% after it was reported that UK GDP fell 2.6% in November – the first monthly decline since the March 2020 low.

Are equities overvalued?

With economies struggling and stock markets trading at close to all time highs, on the face of it stock markets (and the US in particular) look somewhat overvalued. The cyclically adjusted price-earnings (CAPE) ratio which has historically dominated the valuation debate has only been higher than it is now twice, once in the late 1920s and again in the early 2000s. But CAPE doesn’t do is take interest rates into account meaning higher stock prices may be justified given just how low interest rates have become.

Having said that though, low interest rates are low for a reason and symptomatic of a flagging economy, so although the bull market may not be over just yet, it does seem like the music is slowing.

The beginning of a new commodities supercycle

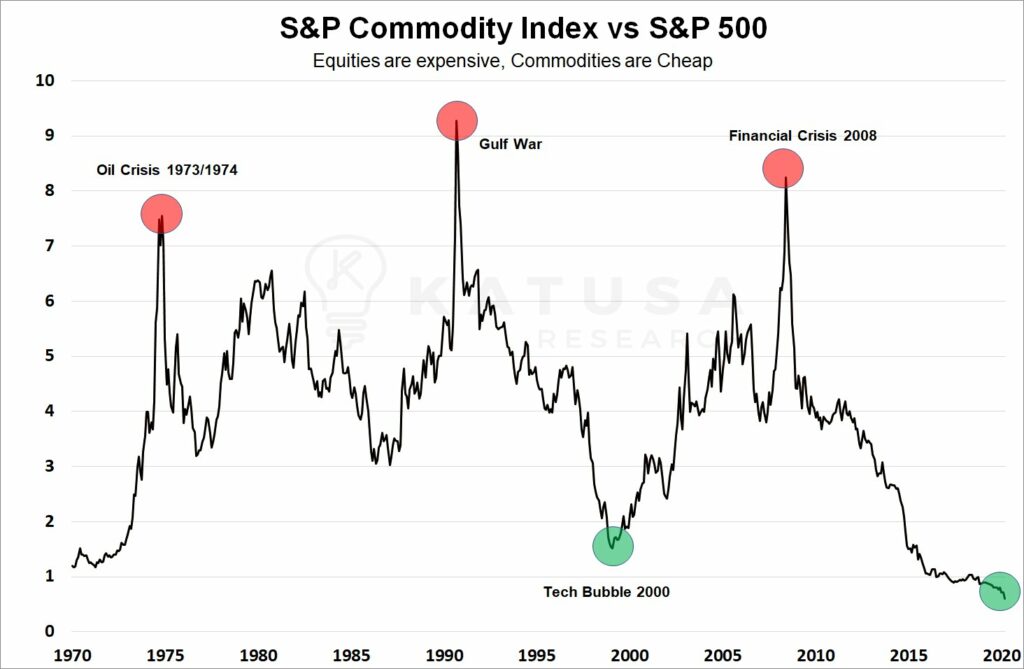

Commodities have been trading incredibly cheaply relative to equities for good number of years now, but the ~10% fall in the dollar strength over the last 12 months and governments planning to spending their economies back into growth after Covid-19, as well as the clean energy/electrification drive, it looks like we might be seeing the beginnings of a new commodity supercycle.

How long a trend it can become will depend on whether the resulting hoped-for growth materialises.